Price-to-Earnings Ratio: What PE Ratio Is And How to Use It

There are many other metrics to consider, including earnings charts, sales figures and other fundamentals of a company. You can also look at the dividend rate if you’re going for dividend investing. If a good price earnings ratio is 20 to 25 times earnings, then a high ratio must be anything above that. In this post, I will share a brief overview of the price earnings ratio to help equip you with another tool to value stocks. The earnings yield is inverse of the P/E ratio—which is calculated as earnings per share divided by price per share. The price-to-earnings ratio (P/E ratio) is a valuation metric used by investors to get an idea of whether a stock is over- or undervalued.

Against their competitors, GD is doing pretty well in the dividend growth department. This is further reinforced by the fact that the payout ratio sits at a comfortable 42%. I think GD is the best pick for investors looking to get some exposure to the industry while also getting an up-front distribution that can be more easily scaled compared to the lower yielding competition. General Dynamics offers a modest dividend yield of 2.4%, paying $5.28 per share. While this yield may not be exceptional, the 5-year growth rate makes me happy at 8%. GD is also a dividend aristocrat; a company that has increased dividend payouts for over 25 consecutive years.

Divide the net earnings available to common shareholders by the average outstanding shares. At at different points, historical trends show that major discrepancies were found, wherein high ratio stocks continued to soar, while lower-priced counterparts remained at rock-bottom rates. Research conducted at Yale in 2000 saw P/E ratios for the S&P index reached historical highs from the close of 2008 to the third quarter of 2009. The index itself grew by 38% at the same period, despite higher investment ratios. Additionally, comparing a tech company for instance, to a utility company is valueless. Utilities are low growth, stable companies with low multiples, while exponential growth and constant change makes tech companies the exact opposite.

For comparison, the average dividend yield of the sector sits at a very small 1.5% alongside the sector’s average 5-year growth rate of 7% per year. If a company’s stock is trading at $30 for one share, and the company’s annual earnings per share is $1, then that company’s P/E ratio is 30/1 or 30x. All that really tells us is that for every $30 stock, the company earns $1 per year. The price-to-earnings, or P/E, ratio is one of the most common financial ratios used by investors to evaluate stocks.

The reading (and its inferences) can also be applied to market indexes, such as the S&P 500, Dow Jones Industrial Average and Nasdaq. Now, if another company in the same industry also has a share price of $50 but an EPS of $20, its P/E ratio would be 2.5, meaning it would cost $2.50 to purchase $1 of that company’s earnings. The second company is the better value, in theory, if all other variables are equal. Some biotechnology companies, for example, may be working on a new drug that will become a huge hit and very valuable in the near future. But for now, that company may have little or no revenue and high expenses.

Terms & Info

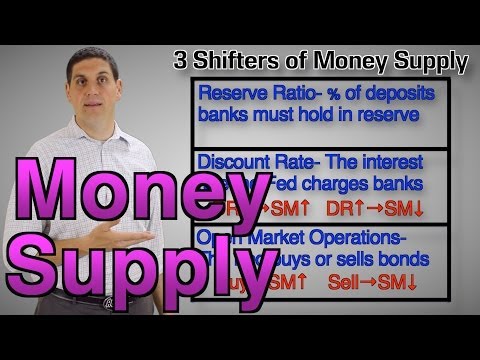

That means it shows a stock or index’s price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period. Moreover, because a company’s debt can affect both the prices of shares and the company’s earnings, leverage can skew P/E ratios as well. For example, suppose who is the poorest shark in shark tank india there are two similar companies that differ primarily in the amount of debt they assume. The one with more debt will likely have a lower P/E value than the one with less debt. However, if the business is good, the one with more debt stands to see higher earnings because of the risks it has taken.

Is PepsiCo, Inc. (PEP) Stock Over or Undervalued? – InvestorsObserver

Is PepsiCo, Inc. (PEP) Stock Over or Undervalued?.

Posted: Wed, 13 Sep 2023 17:19:23 GMT [source]

It’s a good idea for investors to understand the P/E ratio and how to use it to evaluate share prices. It shouldn’t be used alone, and it shouldn’t be used to compare companies that are in different businesses. That said, it is a handy way of seeing if a stock is a bargain or not. (P/E) — A brief overview of the price earnings ratio to help equip you with another tool to value stocks. I am not a licensed investment advisor and this article is not investment advice. Other factors analysts consider when evaluating stocks include the price-to-book ratio (P/B) ratio.

What Is A High P/E Ratio?

This ratio can be used to compare companies of similar size and industry to help determine which company is a better investment. A P/E ratio is also an important metric to help determine the future profitability and growth of a company. So, while considering the PE ratio, what is good depends on the particular market and industry to which the business belongs. Companies in industries that are stable and mature may have moderate growth potential and lower P/E ratios.

It’s only a matter of understanding how to use the P/E ratio effectively. Certain industries like banks work well as they charge higher rates on products. On the other hand, towards the end of the recession, interest rates are low, and banks earn less revenue. While there is no hard and fast rule or value in response to what a good P/E ratio is, most value investors feel lower ratios are better. But for the growth investor, a company with high growth prospects could have a high P/E ratio because investors are bullish about prospects.

Main types of P/E ratios

Whether you’re brand new to investing or have been building your portfolio for years, knowing the answer to “What is a good P/E ratio? ” is valuable information that can help bring added insight into a stock’s health. With an understanding of what a P/E ratio can teach you about a stock, it’s important to also keep the ratio’s shortcomings in mind. By plugging those numbers into the P/E ratio formula, you divide $150.50 by $6.10, which gives you a P/E ratio of 24.67, which is within the market average. The difference between a good and bad P/E ratio is not as cut and dry as it may seem.

Much like the entire business, the value of the stock is linked to the ability of the company to generate cash. The P/E ratio also indicates market expectations regarding future stock performance. Using the P/E ratio, the relative earning power of companies, irrespective of their stock price or size, can be compared. Essentially, the price-earnings ratio indicates the dollar amount investors can expect to invest in a company for one dollar of the earnings.

What is the Price Earnings Ratio?

Earnings per share is the portion of a company’s net income that would be earned per share if all profits were paid out to its shareholders. EPS is typically used by analysts and traders to establish the financial strength of a company. EPS provides the “E” or earnings portion of the P/E valuation ratio. Differentiating between overvalued stocks and growth stocks comes down to further analysis. Or is there a better reason investors are anticipating higher future returns? These are questions you could ask to decide if it might be time to buy, sell or hold.

- Follow this beginner’s guide to learn more about P/E ratios, what they can tell you about a stock, and some of the ratio’s shortcomings.

- When a high or a low P/E is found, we can quickly assess what kind of stock or company we are dealing with.

- And when a “hot stock” falls out of favor, the ensuing price decline can be swift and painful.

- The P/E ratio can tell you a great deal about what investors overall think of a given stock.

A stock market index, such as the S&P 500, can be used to gauge whether the company is over- or undervalued relative to the market. Stash101 is not an investment adviser and is distinct from Stash RIA. But it’s crucial to remember that a P/E ratio is only one metric, and it shouldn’t inform your investing decisions by itself. Because of this, you should take the P/E ratio with a grain of salt and always do your research when short or long-term investing. Additionally, companies may have negative or no earnings, leaving you with either a “0” P/E ratio or a negative one, which is not useful for comparison purposes. It’s used for comparing and ranking companies by size, and for benchmarking the stock returns of a company against an index of comparable companies based on market cap.

Valuation From P/E

The biggest limitation of the P/E ratio is that it tells investors little about the company’s EPS growth prospects. An investor might be comfortable buying in at a high P/E ratio expecting earnings growth to bring the P/E back down to a lower level if the company is growing quickly. But they might look elsewhere for a stock with a lower P/E if earnings aren’t growing quickly enough. The first part of the P/E equation or price is straightforward because the current market price of a stock is easily obtained, but determining an appropriate earnings number can be more difficult. Investors must determine how to define earnings and the factors that impact earnings.

You’ll get an idea of what “very low” is in a specific situation when you look at the industry average. Like anything cheap, for instance a stock with low P/E value could be a bargain or a big disappointment. Wall Street Journal and other noted publications indicate the other measures like price-to-sales and price-to-cash-flow must be considered along with company history and economy strength. According to them, a high-forward ratio means the stock could grow; it could also be an overoptimistic assessment. For the P/E ratio to have predictive value, the key is to examine them over long periods of time, while considering forward looking factors such as economic environment and earnings estimates.

Unlike forward P/E, trailing P/E ratio uses the actual earnings in the recent past, not predictions. It divides the present-day share price by the EPS during the past 12 months. When experts refer to the P/E ratio without specifying which one, they’re most likely talking about trailing P/E.

Tesla has generated $3.53 earnings per share over the last year ($3.53 diluted earnings per share) and currently has a price-to-earnings ratio of 76.9. Earnings for Tesla are expected to grow by 40.14% in the coming year, from $2.94 to $4.12 per share. Tesla has not formally confirmed its next earnings publication date, but the company’s estimated earnings date is Wednesday, October 18th, 2023 based off prior year’s report dates. Many careers in finance use price-to-earnings ratios when looking at potential investments. Investment bankers and investors rely on this ratio to gain insight into a company’s financial health and potential growth. The price-to-earnings ratio can be used to compare a company to its competitors in the same industry.

Hilton Hotels Corporation Common Stock (HLT) Stock: How Does it Score on Fundamental Metrics? – InvestorsObserver

Hilton Hotels Corporation Common Stock (HLT) Stock: How Does it Score on Fundamental Metrics?.

Posted: Wed, 13 Sep 2023 18:19:01 GMT [source]

Some of the most interesting stocks to keep track of are those of successful and big companies. Their P/E ratios are usually high because they are expected to earn even more in the future. The US stock https://1investing.in/ market uses an index called the Standard & Poor’s 500 Index (S&P 500) to track the performance of 500 large companies. A low P/E ratio means that the expectations for the earnings aren’t too high.

There are many other metrics to consider, including earnings charts, sales figures and other fundamentals of a company. You can also look at the dividend rate if you’re going for dividend investing. If a good price earnings ratio is 20 to 25 times earnings, then a high ratio must be anything above that. In this post, I will share a brief overview of the price earnings ratio to help equip you with another tool to value stocks. The earnings yield is inverse of the P/E ratio—which is calculated as earnings per share divided by price per share. The price-to-earnings ratio (P/E ratio) is a valuation metric used by investors to get an idea of whether a stock is over- or undervalued.

Against their competitors, GD is doing pretty well in the dividend growth department. This is further reinforced by the fact that the payout ratio sits at a comfortable 42%. I think GD is the best pick for investors looking to get some exposure to the industry while also getting an up-front distribution that can be more easily scaled compared to the lower yielding competition. General Dynamics offers a modest dividend yield of 2.4%, paying $5.28 per share. While this yield may not be exceptional, the 5-year growth rate makes me happy at 8%. GD is also a dividend aristocrat; a company that has increased dividend payouts for over 25 consecutive years.

Divide the net earnings available to common shareholders by the average outstanding shares. At at different points, historical trends show that major discrepancies were found, wherein high ratio stocks continued to soar, while lower-priced counterparts remained at rock-bottom rates. Research conducted at Yale in 2000 saw P/E ratios for the S&P index reached historical highs from the close of 2008 to the third quarter of 2009. The index itself grew by 38% at the same period, despite higher investment ratios. Additionally, comparing a tech company for instance, to a utility company is valueless. Utilities are low growth, stable companies with low multiples, while exponential growth and constant change makes tech companies the exact opposite.

For comparison, the average dividend yield of the sector sits at a very small 1.5% alongside the sector’s average 5-year growth rate of 7% per year. If a company’s stock is trading at $30 for one share, and the company’s annual earnings per share is $1, then that company’s P/E ratio is 30/1 or 30x. All that really tells us is that for every $30 stock, the company earns $1 per year. The price-to-earnings, or P/E, ratio is one of the most common financial ratios used by investors to evaluate stocks.

The reading (and its inferences) can also be applied to market indexes, such as the S&P 500, Dow Jones Industrial Average and Nasdaq. Now, if another company in the same industry also has a share price of $50 but an EPS of $20, its P/E ratio would be 2.5, meaning it would cost $2.50 to purchase $1 of that company’s earnings. The second company is the better value, in theory, if all other variables are equal. Some biotechnology companies, for example, may be working on a new drug that will become a huge hit and very valuable in the near future. But for now, that company may have little or no revenue and high expenses.

Terms & Info

That means it shows a stock or index’s price-to-earnings (P/E) ratio divided by the growth rate of its earnings for a specified time period. Moreover, because a company’s debt can affect both the prices of shares and the company’s earnings, leverage can skew P/E ratios as well. For example, suppose who is the poorest shark in shark tank india there are two similar companies that differ primarily in the amount of debt they assume. The one with more debt will likely have a lower P/E value than the one with less debt. However, if the business is good, the one with more debt stands to see higher earnings because of the risks it has taken.

Is PepsiCo, Inc. (PEP) Stock Over or Undervalued? – InvestorsObserver

Is PepsiCo, Inc. (PEP) Stock Over or Undervalued?.

Posted: Wed, 13 Sep 2023 17:19:23 GMT [source]

It’s a good idea for investors to understand the P/E ratio and how to use it to evaluate share prices. It shouldn’t be used alone, and it shouldn’t be used to compare companies that are in different businesses. That said, it is a handy way of seeing if a stock is a bargain or not. (P/E) — A brief overview of the price earnings ratio to help equip you with another tool to value stocks. I am not a licensed investment advisor and this article is not investment advice. Other factors analysts consider when evaluating stocks include the price-to-book ratio (P/B) ratio.

What Is A High P/E Ratio?

This ratio can be used to compare companies of similar size and industry to help determine which company is a better investment. A P/E ratio is also an important metric to help determine the future profitability and growth of a company. So, while considering the PE ratio, what is good depends on the particular market and industry to which the business belongs. Companies in industries that are stable and mature may have moderate growth potential and lower P/E ratios.

It’s only a matter of understanding how to use the P/E ratio effectively. Certain industries like banks work well as they charge higher rates on products. On the other hand, towards the end of the recession, interest rates are low, and banks earn less revenue. While there is no hard and fast rule or value in response to what a good P/E ratio is, most value investors feel lower ratios are better. But for the growth investor, a company with high growth prospects could have a high P/E ratio because investors are bullish about prospects.

Main types of P/E ratios

Whether you’re brand new to investing or have been building your portfolio for years, knowing the answer to “What is a good P/E ratio? ” is valuable information that can help bring added insight into a stock’s health. With an understanding of what a P/E ratio can teach you about a stock, it’s important to also keep the ratio’s shortcomings in mind. By plugging those numbers into the P/E ratio formula, you divide $150.50 by $6.10, which gives you a P/E ratio of 24.67, which is within the market average. The difference between a good and bad P/E ratio is not as cut and dry as it may seem.

Much like the entire business, the value of the stock is linked to the ability of the company to generate cash. The P/E ratio also indicates market expectations regarding future stock performance. Using the P/E ratio, the relative earning power of companies, irrespective of their stock price or size, can be compared. Essentially, the price-earnings ratio indicates the dollar amount investors can expect to invest in a company for one dollar of the earnings.

What is the Price Earnings Ratio?

Earnings per share is the portion of a company’s net income that would be earned per share if all profits were paid out to its shareholders. EPS is typically used by analysts and traders to establish the financial strength of a company. EPS provides the “E” or earnings portion of the P/E valuation ratio. Differentiating between overvalued stocks and growth stocks comes down to further analysis. Or is there a better reason investors are anticipating higher future returns? These are questions you could ask to decide if it might be time to buy, sell or hold.

- Follow this beginner’s guide to learn more about P/E ratios, what they can tell you about a stock, and some of the ratio’s shortcomings.

- When a high or a low P/E is found, we can quickly assess what kind of stock or company we are dealing with.

- And when a “hot stock” falls out of favor, the ensuing price decline can be swift and painful.

- The P/E ratio can tell you a great deal about what investors overall think of a given stock.

A stock market index, such as the S&P 500, can be used to gauge whether the company is over- or undervalued relative to the market. Stash101 is not an investment adviser and is distinct from Stash RIA. But it’s crucial to remember that a P/E ratio is only one metric, and it shouldn’t inform your investing decisions by itself. Because of this, you should take the P/E ratio with a grain of salt and always do your research when short or long-term investing. Additionally, companies may have negative or no earnings, leaving you with either a “0” P/E ratio or a negative one, which is not useful for comparison purposes. It’s used for comparing and ranking companies by size, and for benchmarking the stock returns of a company against an index of comparable companies based on market cap.

Valuation From P/E

The biggest limitation of the P/E ratio is that it tells investors little about the company’s EPS growth prospects. An investor might be comfortable buying in at a high P/E ratio expecting earnings growth to bring the P/E back down to a lower level if the company is growing quickly. But they might look elsewhere for a stock with a lower P/E if earnings aren’t growing quickly enough. The first part of the P/E equation or price is straightforward because the current market price of a stock is easily obtained, but determining an appropriate earnings number can be more difficult. Investors must determine how to define earnings and the factors that impact earnings.

You’ll get an idea of what “very low” is in a specific situation when you look at the industry average. Like anything cheap, for instance a stock with low P/E value could be a bargain or a big disappointment. Wall Street Journal and other noted publications indicate the other measures like price-to-sales and price-to-cash-flow must be considered along with company history and economy strength. According to them, a high-forward ratio means the stock could grow; it could also be an overoptimistic assessment. For the P/E ratio to have predictive value, the key is to examine them over long periods of time, while considering forward looking factors such as economic environment and earnings estimates.

Unlike forward P/E, trailing P/E ratio uses the actual earnings in the recent past, not predictions. It divides the present-day share price by the EPS during the past 12 months. When experts refer to the P/E ratio without specifying which one, they’re most likely talking about trailing P/E.

Tesla has generated $3.53 earnings per share over the last year ($3.53 diluted earnings per share) and currently has a price-to-earnings ratio of 76.9. Earnings for Tesla are expected to grow by 40.14% in the coming year, from $2.94 to $4.12 per share. Tesla has not formally confirmed its next earnings publication date, but the company’s estimated earnings date is Wednesday, October 18th, 2023 based off prior year’s report dates. Many careers in finance use price-to-earnings ratios when looking at potential investments. Investment bankers and investors rely on this ratio to gain insight into a company’s financial health and potential growth. The price-to-earnings ratio can be used to compare a company to its competitors in the same industry.

Hilton Hotels Corporation Common Stock (HLT) Stock: How Does it Score on Fundamental Metrics? – InvestorsObserver

Hilton Hotels Corporation Common Stock (HLT) Stock: How Does it Score on Fundamental Metrics?.

Posted: Wed, 13 Sep 2023 18:19:01 GMT [source]

Some of the most interesting stocks to keep track of are those of successful and big companies. Their P/E ratios are usually high because they are expected to earn even more in the future. The US stock https://1investing.in/ market uses an index called the Standard & Poor’s 500 Index (S&P 500) to track the performance of 500 large companies. A low P/E ratio means that the expectations for the earnings aren’t too high.